The bond market is down more than 50 points as I type this update. That’s certainly not how we wanted to start this week. Especially after sharp mortgage rate increases over the past several weeks impacting buyer demand, builder sentiment, and homebuyers across the country. The best part of interest rates peaking, is that they’re peaking. We have reason to believe rates will improve over the next year. There is hope ahead, this mortgage rate environment is temporary. UBS stated high quality bonds should outperform cash in most of the Fed scenarios over the next 6-12 months. A great outlook for bond investors. Below is a quote from the article. Remember, as bond prices go up, mortgage rates go down (historically). Investor confidence is important. Selling bonds, drives their price down. A 50+ drop in the bond market today means, mortgage rates just increased again. What can happen over the next year? “Many investors sold high-quality bonds in the post-financial-crisis period of ultra-low interest rates. However, we think high-quality debt has an important role in portfolios as both a source of returns and long-term diversifier. Based on our capital market assumptions, we expect bonds in general to offer between 15% and 25% total returns over the next five years, depending on currency and credit quality. Historical data is also supportive. US government bonds have outperformed USD cash in 83% of five-year periods since 1925. If we look at all five-year periods since January 1977 (the earliest point with available data on a higher 2-year than 10-year Treasury yield, known as curve inversion), US government bonds have outperformed in about 90% of the time, and in 97% of five-year periods when the yield curve was inverted at the beginning of the five-year period.” We have lots of news on the way. Look for important updates in the labor sector starting Tuesday with news on job openings via the JOLTS report for August. Wednesday brings ADP’s Employment Report for September, which measures private payrolls, while the latest Jobless Claims will be reported on Thursday. The biggest headline comes Friday with September’s Jobs Report from the Bureau of Labor Statistics, which includes Non-farm Payrolls and the Unemployment Rate. A quick recap of last week’s news: Home prices in the United States have been consistently rising, with both the Case-Shiller Home Price Index and the Federal Housing Finance Agency's House Price Index reporting increases in July. The FHFA's index focuses on lower-priced homes and excludes cash buyers and jumbo loans, which can lead to differences in the reported figures. Home values have reached new all-time highs, recovering from the 2022 downturn, and are expected to appreciate between 5-9% this year. Initial unemployment claims increased slightly, but the overall level of first-time filings remains low, indicating that employers are retaining workers. Continuing claims have been trending lower, suggesting a combination of people finding new jobs and benefits expiring. The Federal Reserve is closely monitoring labor market data as they consider further rate hikes, with their next rate decision scheduled for November 1. In summary, the housing market is showing continued price appreciation, and the labor market remains stable, with the Federal Reserve closely watching these factors for potential rate adjustments. August's Personal Consumption Expenditures (PCE) showed that headline inflation increased by a lower-than-expected 0.4%, with the year-over-year reading rising from 3.4% to 3.5% due to prior reporting revisions. Core PCE, which excludes volatile food and energy prices, rose by 0.1% in August, with the year-over-year reading falling from 4.3% to 3.9% - the lowest in two years. Despite elevated inflation, it has improved significantly from last year's peak of 7.1% and is now at 3.5% on the headline reading. If we annualize the last six months of Core PCE readings, it equals 2.9%, a drop from the previous 3.4% and just above the Fed's 2% target. Whether this progress will lead the Fed to pause further rate hikes will be decided at their next meeting on November 1. Pending Home Sales fell 7.1% from July to August and were 18.7% lower than a year ago, indicating potential lower closings in September. Some potential homebuyers are delaying purchases due to high rates and low inventory. It goes without saying, increased housing inventory and better interest rates are seen as essential to revive the housing market. 26% of homebuyers reported fatigue from dealing with multiple offer situations, which is still a reality in many markets. New Home Sales fell 8.7% from July to August but are still higher than the previous year. The new construction market is seeing demand due to a lack of existing homes for sale, but more available supply of new homes is needed to meet this demand. The tight supply of both existing and new homes is expected to support home prices, even though the median sales price for new homes decreased, which can be influenced by the mix of lower-priced and higher-priced homes in sales data. There are mixed trends in inflation, with some improvement, and challenges in the housing market related to sales and supply. Transaction volume is down, which have implications to the overall economy. The billion dollar question is, where will the much needed increase in inventory come from? | |

HOUSING AT A STANDSTILL | |

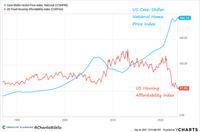

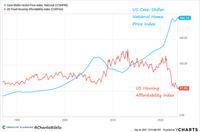

Pending home sales in the US are down to their lowest levels since April 2020. Rising interest rates, and home prices have accomplished the Fed’s goal to reduce demand. To be exact, they wanted demand destruction to drive prices down. Affordability is at all time lows and the average American family needs to spend about 44% of their income to afford a mortgage payment. Most homebuyers finance their purchase and put little down leaving no option for payment relief without a significant seller concession. Below I’ve posted a chart showing price appreciation. Home prices are up 40% in just the last three years. Without a surplus of inventory, and decent demand, this trend is not likely to change. Even if we enter an official recession, mortgage rates would improve, and demand would increase. There are many approved buyers on the sidelines now, just waiting for a break in action. Inventory can pick up, but I believe demand will outpace supply. | |

| |

The most significant contributor to the Consumer Price Index (CPI) is Shelter. The cost of rent is expected to continue to go down because US rents have fallen by 1.2% compared to a year ago, marking the most significant year-over-year decline since December 2020. The Fed wants to see concrete evidence, in the form of lower CPI and rising unemployment to shift gears and stop hiking this year. The longer it takes to tame inflation, the longer it will take for homebuyers to get the much needed relief in affordability. Unfortunately, unemployment is expected to improve slightly tomorrow. Affordability is not a new issue. Although payments are more manageable with lower rates, competition is much more stiff. Many homebuyers are waiting for rates to drop, and many are tired of competing with several other buyers. The good and bad news is, rates will improve, but the competition will increase and I expect home prices to continue to rise. Although homeownership is a safe long term investment, it’s quickly becoming a luxury. | |

| |

DOES IT MAKE SENSE TO BUY NOW? | |

In every market, and for each individual, the answer is different. Meet with me to analyze the cost of waiting in your market. We will adjust for inflation, and look at the numbers based on homes in your price range. We can also look at the cost of waiting by comparing the cost to rent instead of buying, despite higher rates. Real estate remains a safe long-term investment. One of the most significant benefits of homeownership is the opportunity to build equity in your home. As you make mortgage payments, you're gradually paying down the principal balance of your loan. Additionally, if your home appreciates in value over time, you can build even more equity. This equity can serve as a valuable asset that can be tapped into through home equity loans or lines of credit, or it can be realized when you sell the property. Homeownership provides a sense of stability and control that renting does not. When you own a home, you have more control over how you want to use and customize the space. You don't have to worry about landlords raising rent or imposing restrictions on your living arrangements. Owning a home can also provide a sense of community and belonging, as you become a part of a neighborhood and can establish long-term relationships with neighbors. This interest rate environment is temporary. The scarcity that makes real estate work as a solid investment is not. Buying a home is becoming a luxury and there is no immediate solution for housing affordability. Inventory cannot magically increase driving prices down. Do the math, if it works for you, take the leap. Article Written and provided by Padi Goodspeed of CCM Mortgage |

Market Moving News this Week

-

Blog

-