MARKET MOVING NEWS THIS WEEKOn Thursday, the Federal Reserve will release its preferred inflation measures, including the personal consumption expenditures price index (PCE). The market is expecting the headline and core numbers to come in lower than expectations supporting a downward trend in inflation. Last month, headline PCE fell to 3.4% in-line with expectations. The headline forecast this week is 3.1%. Core PCE is expected to come in at 3.5%, down from 3.7%. This could be GREAT news for mortgage rates.

This week is packed with housing news, beginning with October's New Home Sales Today. Tuesday will feature updates on September's home price appreciation from Case-Shiller and the Federal Housing Finance Agency. On Thursday, we'll see October's Pending Home Sales. Additionally, Wednesday brings the second reading of the third quarter GDP. Wrapping up the week, Thursday will also include the latest Jobless Claims with the PCE report. Fed Chair Jerome Powell speaks on Friday. I will tune in and share relevant news on X and Threads. BREAKING: NEW HOME SALES CRASHEDHeadlines like this are dramatic by design. Some will be confused, and some will feel validated. Let’s take a closer look at the new home sales report issued today.

New home sales dropped 5.6% to a seasonally adjusted annual rate of 679,000 units last month, per the Commerce Department's Census Bureau. September's sales pace was revised lower to 719,000 units from the previously reported 759,000 units.

According to the Census Bureau and the Department of Housing and Urban Development, the median sales price of a new home has decreased to $409,300 from $496,800. Despite this reduction, which marks a decline of over 17% from the previous year, the prices are still significantly higher than those seen before the pandemic.

In October, sales of new single-family homes in the U.S. dropped more than anticipated. This decline was largely attributed to higher mortgage rates that deterred buyers despite builders lowering prices. This downturn is likely a temporary due to the ongoing shortage of previously owned houses on the market. The Commerce Department's Monday report aligns with the recent decline in homebuilder sentiment. Mortgage rates peaking at 8.03% on the 30-year fixed mortgage certainly led to expectations of reduced buyer traffic. Nevertheless, mortgage rates have recently decreased from their two-decade peak to levels with the average 30 year fixed rate down to 7.35% as of this morning, suggesting a potential upswing in sales soon.

Mortgage applications increased for two weeks in a row following news of rate improvements. “Crashed” is a strong word. Stay ahead of this news and your buyers and sellers will be seeing it. The chart below shows how traffic is impacted by higher mortgage rates. It would be reasonable to assume the opposite effect as rates improve.

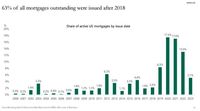

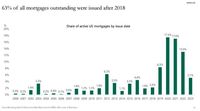

Inventory continues to be an issue because 63% of the existing mortgages are less than half of the current mortgage rate. 40% of homes in the US don’t have mortgages. Builders can’t build fast enough and sellers need to feel they can afford their replacement property with current rates. It makes sense right?

As inflation improves, mortgage rates will improve, and these predictions and conclusions can change quickly. The key takeaway is to be ready, and well informed when shopping. Between now and Feb 28, 2024, its going to be a great time to negotiate on price and terms.

|

|

|

|

The Conference Board has announced a 0.8% decline in the Leading Economic Indicators (LEI) for October, marking the nineteenth consecutive month of decreases. LEI is a key predictor of the economy's future direction, and according to Justyna Zabinska-La Monica, Senior Manager of Business Cycle Indicators, both its six- and twelve-month growth rates remained in negative territory in October. This trend historically precedes a recession, with an average lead time of 22 months, similar to the period leading up to the Great Recession from 2007 to 2009.

Zabinska-La Monica notes that the Conference Board anticipates factors such as high inflation, elevated interest rates, and reduced consumer spending — due to the depletion of pandemic savings and the resumption of student loan payments — to trigger a brief recession in the U.S.

Despite the negative implications of a recession for the economy, one silver lining is that recessions typically bring lower interest rates. This trend could offer some relief in the economic landscape, balancing the overall impact.

SOMETHING TO THINK ABOUT:

Black Friday shopping set a new record in the US with $9.8 billion in online sales, marking a 7.5% increase from last year. Additionally, on Thanksgiving, the day preceding Black Friday, online sales in the US reached $5.6 billion. This brings the total for the two-day period to $15.4 billion. On a global scale, online sales during Black Friday surpassed $70 billion for the first time in history.

Are higher rates really making consumer spending tougher? Could this be the most resilient economy we’ve experienced in our lifetimes? Headlines alone do not tell the full story.

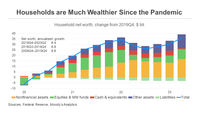

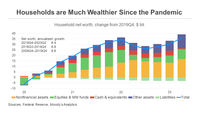

The resilience of the economy is partly due to how well asset prices have adapted to the Federal Reserve's tightening measures. Although markets for stocks, bonds, and real estate, which were previously overvalued, have experienced adjustments, they have managed to avoid significant collapse. This has helped maintain the wealth of Americans at a level higher than it was before the pandemic, which is a crucial factor in their continued spending. This sustained consumer spending, in turn, contributes to the overall strength and stability of the economy.

HOME PRICES: CASE SHILLER AND FHFA

Tomorrow morning, we're in for an insightful update as Case-Shiller and the FHFA unveil their latest home price indices. It's an interesting time to watch the housing market, as home prices typically dip in the second half of the year – a trend clearly depicted in the accompanying graph.

What's noteworthy is the shift we're witnessing in the housing market. After three years of skyrocketing prices, a moderation in home values is a welcome change. This, coupled with rising incomes and potentially lower mortgage rates, brings us closer to making homeownership a reachable goal for many families, a core aspect of the American Dream.

However, as we observe prices stabilizing, some may prematurely sound the alarm bells, suggesting a market crash. It's crucial to stay ahead of this narrative and clarify the reality: what we're seeing is not a crash, but a return to normalcy after years of exceptional growth. This adjustment phase is a healthy and necessary step towards a more balanced market. |

|

|