Market Moving News this Week

Hi Friends!

Welcome back to another week of diving deep into the housing market and what's happening in the economy. Economic data and events are like a compass for investors, analysts, and homebuyers, helping us navigate the turbulent waters of the market. This week, a treasure trove of crucial economic data is being released, with significant implications for homebuyers and the broader economy.

Key Economic Reports

June’s Inflation Data: Consumer Price Index (CPI) - Thursday

The CPI is a pivotal measure of inflation at the consumer level, reflecting the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. This report offers crucial insights into current inflationary pressures, which directly impact the cost of living and purchasing power.

Producer Price Index (PPI) - Friday

The PPI measures the average change over time in the selling prices received by domestic producers for their output. It serves as a leading indicator of consumer price inflation, as increases in producer prices often trickle down to consumers. This report will shed light on wholesale inflation trends and potential future price increases for consumers.

Weekly Jobless Claims

Jobless claims data provide a weekly snapshot of the number of individuals filing for unemployment benefits. Recent increases in jobless claims are critical for gauging the health of the labor market and potential economic slowdowns. This data can signal shifts in employment trends and overall economic stability.

Significant Events

Fed Chair Powell Testifies - Tuesday

Federal Reserve Chair Jerome Powell’s testimony before Congress is a major event, as it provides insights into the Fed’s outlook on the economy, monetary policy, and future interest rate decisions. His words are closely monitored by the markets, and any hints about rate cuts or economic concerns can lead to significant market movements.

OPEC Monthly Report - Wednesday

The Organization of the Petroleum Exporting Countries (OPEC) will release its monthly report, which includes vital data on oil production, demand forecasts, and insights into global energy markets. Given that fuel prices affect nearly every aspect of the economy, this report is highly anticipated.

Michigan Consumer Sentiment Data - Friday

This report measures consumer confidence in economic activity. Higher consumer sentiment often translates to increased consumer spending, which drives economic growth. It’s a key indicator of how optimistic or pessimistic consumers are about their financial prospects.

Fed Speakers

Throughout the week, there will be several speaking engagements by Federal Reserve officials. Their comments can influence market expectations about monetary policy and economic conditions. With nine Fed speaker events on the calendar, investors and analysts will be listening for any signs of reassurance about rate cuts this year.

Why These Events Matter

Inflation Data (CPI and PPI)

Inflation directly impacts purchasing power, interest rates, and overall economic stability. High inflation can lead to increased borrowing costs and reduced consumer spending. The Fed closely monitors inflation data to justify rate cuts, aiming to stimulate the economy. However, it’s a delicate balance, as cutting rates too soon can have adverse effects.

Jobless Claims

Rising jobless claims indicate a weakening job market, which can hamper economic growth and consumer spending. Data supporting rising unemployment will likely bolster the case for a rate cut. When the bond market starts predicting a higher probability of a cut, mortgage rates typically improve. Understanding the inverse relationship between bond prices and yields is key here: as bond prices fall, yields rise, leading to higher borrowing costs, including mortgage rates.

Impact on Mortgage Rates

Inflation news significantly influences mortgage rates. When investors expect higher future interest rates or inflation, they may sell bonds, causing bond prices to fall and yields to rise. This increase in bond yields translates to higher mortgage rates. Conversely, positive inflation news (like lower-than-expected CPI) can boost bond prices and lower yields, leading to better mortgage rates for homebuyers.

June’s Inflation Data Breakdown

Headline Inflation

The headline CPI measures the total inflation within an economy, including all goods and services. If June’s CPI increase is 0.1%, the annual headline inflation is expected to decrease from 3.3% to 3.1%, which would be positive for bonds and potentially lower mortgage rates.

Core Inflation

Core CPI excludes volatile food and energy prices, providing a clearer view of long-term inflation trends. Predictions for core inflation vary between 0.2% and 0.3% monthly increases. If core inflation rises to 0.3%, the annual rate could increase to 3.5%, likely negatively impacting the market.

Future of Mortgage Rates

The market is now pricing in a 78% probability of a Fed rate cut in September, up from 64% a week ago and 50% a month ago. Several factors contribute to this expectation, including rising unemployment, slowing job growth, and falling inflation.

Rising Unemployment

Unemployment has risen to 4.1%, the highest since November 2021. This increase signals a softening labor market, which could prompt the Fed to cut rates to stimulate growth.

Slowing Jobs Growth

Job growth is at 1.7% year-over-year, the lowest since March 2021. This slowdown is another indicator of economic weakening, supporting the case for a rate cut.

Slowing Wage Growth

Wage growth has slowed to 3.9% year-over-year, the lowest since May 2021. Slower wage growth reduces consumer spending power, impacting overall economic health.

Falling Inflation

The Core Personal Consumption Expenditures (PCE) index has risen by 2.6% year-over-year, the lowest since March 2021. Lower inflation readings increase the likelihood of a rate cut.

The Sahm Rule

The "Sahm Rule," created by macroeconomist Claudia Sahm, signals the early stages of a recession when the three-month moving average of the U.S. unemployment rate increases by half a percentage point or more compared to the lowest three-month moving average over the past 12 months. The current three-month moving average is 0.43 percentage points above its cycle low. If it surpasses 0.50 percentage points, the Sahm Rule would confirm a recession.

Economic Indicators and Homebuying

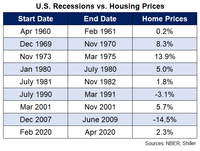

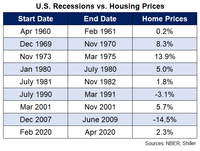

Potential Benefits

- Lower Interest Rates: During a recession, central banks often lower interest rates to stimulate the economy. Lower mortgage rates can make buying a home more affordable.

- Increased Affordability: Reduced demand can lead to lower home prices, benefiting financially stable buyers.

Potential Drawbacks

- Falling Home Prices: Decreased demand can negatively impact home prices, affecting current homeowners.

- Tighter Credit Conditions: Lenders may become more cautious, making it harder for buyers to qualify for mortgages.

- Increased Foreclosures: Economic hardships can lead to more foreclosures, flooding the market with distressed properties and depressing prices.

Bet on Homeownership

Even if you didn’t own a home during the 2008 housing crisis, you likely remember its impact. Many people worry about a similar event happening again, but the current market is different. Today, there is an undersupply of houses, even with recent inventory growth.

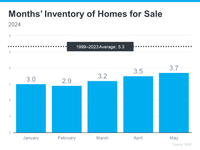

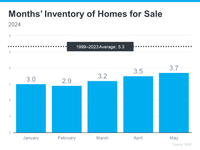

Current Housing Supply Dynamics

- Existing Homes: Despite a year-over-year increase, the supply of existing homes is still low overall.

- New Home Construction: Builders are cautious and underbuilding compared to pre-crisis levels.

- Distressed Properties: Stricter lending standards have led to fewer foreclosures, preventing a flood of distressed properties.

This week’s economic data and events are crucial for shaping the outlook on interest rates and the housing market. As we navigate these turbulent waters, it’s essential to stay informed and understand how these indicators impact the broader economy and homebuying conditions.