Hi Friends,

This week is shaping up to be a pivotal one for the economy, with key updates on inflation, interest rates, consumer spending, and the housing market. Let’s take a closer look at what’s happening and how it may impact you.

The Federal Reserve’s Upcoming Decision on Interest Rates

On Wednesday, the Federal Reserve will announce its second interest rate decision of 2025. Federal Reserve Chair Jerome Powell will provide insight into the central bank’s current stance on inflation, economic growth, and the potential for future rate cuts. Given that inflation remains persistent and recession concerns are growing, this decision could have significant implications for financial markets and the housing sector.

Consumer Sentiment Declining for a Third Consecutive Month

Consumer confidence has been deteriorating, with sentiment dropping another 11 percent in March. This marks the third straight month of decline, resulting in a cumulative 22 percent decrease since December 2024. The downturn in sentiment has been widespread, affecting individuals across all demographics, including different age groups, education levels, income brackets, geographic locations, and political affiliations. Notably, economic confidence among Republicans has fallen sharply, with their expectations index declining by 10 percent in March alone.

Inflation Pressures Remain Stubborn

The latest estimates indicate that Core PCE inflation for February will be around 0.34 percent, slightly above January’s reading. This suggests that inflationary pressures are still embedded in key areas of the economy, even though broader measures such as the Consumer Price Index (CPI) and the Producer Price Index (PPI) have shown some moderation. As a result, the annual Core PCE inflation rate is projected to rise to approximately 2.75 percent, up from 2.65 percent in January.

Why a Rate Cut is Unlikely This Week

Given the persistent inflationary pressures and uncertain economic outlook, it is unlikely that the Federal Reserve will move to cut interest rates at this time. Lowering rates too soon could risk reigniting inflation, which would be counterproductive to the Fed’s long-term goals of achieving price stability.

Key Economic Events to Watch This Week

February Retail Sales Report (Released Today)

Retail sales increased by 0.2 percent overall in February, a modest gain that suggests consumer spending remains somewhat resilient.

Sales excluding automobiles rose by 0.3 percent, while sales excluding both automobiles and gasoline rose by 0.5 percent.

Core retail sales, which provide a clearer picture of underlying consumer demand, increased by a stronger 1.0 percent.

However, downward revisions to January’s sales figures suggest that consumer spending in the prior month was weaker than initially reported.

Spending at restaurants and bars has been declining for several months, which could be an early indicator of shifting consumer behavior in response to economic uncertainties.

February Housing Starts Report (Tuesday)

This data measures new residential construction activity. An increase in housing starts signals growing builder confidence and suggests that additional housing supply may be entering the market, which is positive for homebuyers struggling with limited inventory.

Federal Reserve Interest Rate Decision and Statement (Wednesday)

This announcement will be closely watched for any signals regarding future monetary policy actions.

If the Fed suggests that rate cuts are on the horizon, mortgage rates could begin to decline, making homeownership more affordable.

Initial Jobless Claims Report (Thursday)

This report provides a snapshot of labor market conditions. A rise in unemployment claims could indicate economic slowing and increase the likelihood of future rate cuts.

Philadelphia Fed Manufacturing Index (Thursday)

This index measures manufacturing activity in the Philadelphia region. A decline in this index may signal broader economic weakness, which could contribute to downward pressure on mortgage rates.

February Existing Home Sales Report (Thursday)

This report provides insight into the strength of the housing market. Higher sales numbers indicate strong demand despite elevated mortgage rates, while weaker sales may suggest affordability concerns and shifting market conditions.

Are We Entering a Period of Stagflation?

Stagflation occurs when an economy experiences stagnant growth, rising inflation, and increasing unemployment simultaneously. Historically, stagflation has been rare, but it poses significant economic challenges when it occurs. While current economic conditions do not yet meet the full definition of stagflation, the combination of persistent inflation and weakening consumer sentiment warrants careful monitoring.

For homeowners, stagflation can be a mixed experience. Those with fixed-rate mortgages may be protected from rising interest rates, but the overall cost of living—including expenses such as groceries, utilities, and home maintenance—would continue to rise. Additionally, home prices may not appreciate significantly in real terms due to broader economic stagnation.

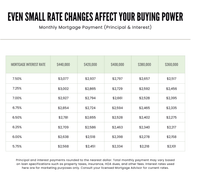

For prospective homebuyers, stagflation presents even greater challenges. Rising inflation erodes purchasing power, making it harder to save for a down payment. At the same time, higher interest rates increase borrowing costs, leading to less affordable mortgage payments. If wages do not keep pace with inflation, many buyers may find themselves priced out of the housing market.

Real-Time Inflation Data: What It Tells Us

While traditional measures of inflation, such as the CPI, are reported monthly with some lag, alternative data sources like Truflation provide a more immediate picture of price trends. Truflation aggregates data from multiple sources and updates inflation estimates daily. Some reports indicate that Truflation’s readings have been as low as 1.3 percent in early March 2025, suggesting that inflationary pressures may be cooling faster than conventional measures suggest.

At the same time, survey-based expectations of inflation, such as those from the University of Michigan, have been rising. The latest survey shows year-ahead inflation expectations have climbed to 4.9 percent, up from 4.3 percent in the previous month. However, these expectations are based on sentiment rather than actual price changes, meaning they can be influenced by political and economic uncertainty rather than real economic conditions.

What This Means for Homebuyers

Recent data suggests that homebuyer interest is increasing as mortgage rates trend lower. Mortgage applications rose by 7 percent last week, reaching their highest level since early February 2025. Google searches for “homes for sale” have increased by 10 percent compared to last year, and Redfin’s Homebuyer Demand Index is at its strongest level since January.

However, despite rising interest, pending home sales remain down 6.1 percent compared to last year. This suggests that while more buyers are entering the market, many remain cautious about making a purchase.

Meanwhile, home listings are increasing, with inventory up 3.1 percent year-over-year. A rising number of listings may help ease inventory shortages and provide more options for buyers in the coming months.

Should You Buy Now or Wait?

Interest Rates Are Expected to Fall, But the Timing is Uncertain

The Fed has not yet cut rates, but a weakening labor market may force a shift in policy later this year.

If rates decline, mortgage rates will likely follow, making homeownership more affordable.

Those who purchase now can refinance later if rates drop further.

Home Prices Are Still Increasing

National home prices are rising at an annual rate of 3 to 4 percent.

Buying now secures today’s pricing, preventing future increases from making homes less affordable.

Rising Inventory Could Help Buyers

More homes are coming on the market, which could provide better selection and more negotiating power.

Final Thoughts

If you are financially prepared and find a home that meets your needs, buying now could be a smart decision. Waiting for lower rates may result in higher home prices and increased competition. While there is no perfect time to buy, real estate remains a powerful tool for long-term wealth building.